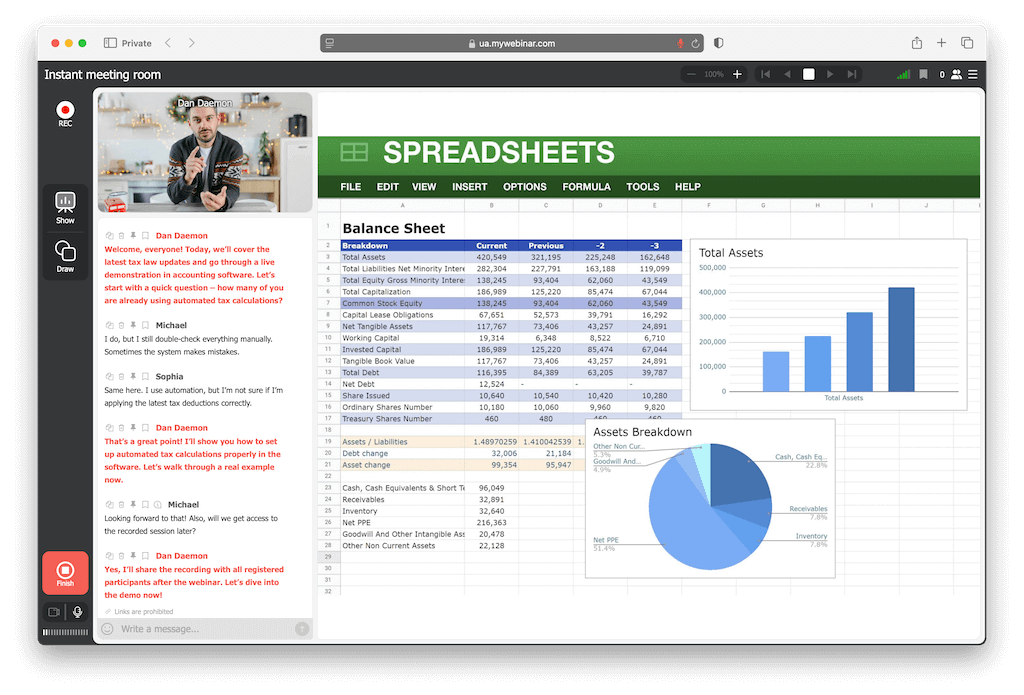

Accounting requires both theoretical knowledge and hands-on experience. Webinar tools for accountants ready to lead with knowledge make it easy to host real-time discussions on legislative updates, complex accounting scenarios, and software demonstrations. With these tools, you can assess participants’ knowledge through testing, identify mistakes, and adapt training to their needs. This interactive approach improves knowledge retention, helping accountants work more efficiently and avoid costly errors or compliance issues

Accounting webinars help professionals stay updated on tax laws, improve financial reporting, master bookkeeping software, and enhance compliance with regulatory changes

Teach accountants about regulatory changes, demonstrate accounting software, and conduct knowledge assessments. Start your first webinar today

Proudly crafted and hosted in the EU since 2013.

DMARC monitoring by RUA•Watcher.